Investments can be tricky to operate. They require being familiar with key matters, strategies, and trends. Without adequate knowledge, one could encounter difficulties. As such, it is imperative to possess a thorough understanding of fundamental principles to make informed choices.

In the event that one is interested in acquiring additional knowledge regarding investment methods, Dovrixal provides a connection to educators who are equipped to instruct. Our objective is to see to the user’s financial literacy through the streamlined access we offer.

Structured learning is easier with Dovrixal's personalized educator connections. Access to tailored education is simple and uncomplicated, whether looking to learn the basics of investing or polish expertise.

Knowledge is the foundation of money management. Dovrixal emphasizes the value of education before action. This is the point at which financial training prepares users for market fluctuations and investment strategies, regardless of whether they are at the beginning or pursuing advancement.

Dovrixal is founded on the principle that suitable education is the foundation of informed decision-making. The development of essential financial competencies is facilitated by the connection of learners with the appropriate instructors.

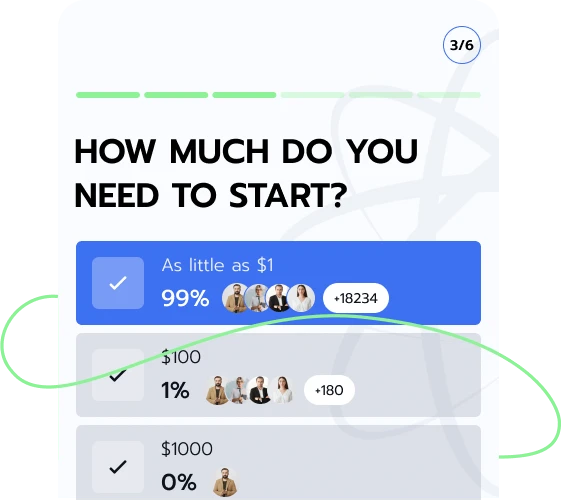

Dovrixal is designed to be accessible, welcoming participants of all levels and ensuring that financial education is within reach, irrespective of their background or experience.

Our objective is to facilitate accessibility to financial education for all. Clarity and skills are essential for making informed investment decisions, so Dovrixal serves as an entry point to essential training and resources.

The journey toward financial literacy and objective investment decisions is simplified by Dovrixal, which connects participants with educators who are appropriate for their objectives.

With a simplified sign-up process, users can immediately access customized financial education resources.

Users are connected to financial education groups that specialize in customized learning upon completing the registration process with Dovrixal. This method is specifically designed to meet the learning objectives of each individual.

An educational representative is assigned to provide guidance after the match, ensuring a seamless induction process and ongoing learning assistance.

Finding suitable financial education is a challenge for a lot of prospective investors. By providing direct access to tutors who simplify intricate financial concepts into practical, comprehendible lessons, Dovrixal resolves this roadblock.

Learners are introduced to market trends, risk assessment, and strategic budgeting through Dovrixal, which functions as an entry point into financial education. Participants acquire the knowledge necessary to navigate investment landscapes as a result of this structured approach.

Financial matters are more than just numbers and also involve making strategic choices that have an impact on financial results. By bridging the gap between curiosity and learning, Dovrixal helps users understand money issues and sets the stage for financial enlightenment.

The financial sector is a huge field where one could encounter inherent risks, emerging market trends, and diverse opportunities. Every change in the economy could have an impact. As such, flexible strategies that help investors adjust to an ever-evolving market can be learned through Dovrixal. Registration is free, promising individuals straight access to essential financial grounding.

Continuous learning drives advancement. Investor expertise is strengthened by a commitment to financial education. Dovrixal facilitates the quest for financial literacy. Our website provides access to structured learning experiences to all those who seek.

Investments: A Spectrum that Keeps Evolving

Every investment path is like a story that changes over time, shaped by changes in the market and strategic decisions. To get around in this landscape, one needs to be focused, flexible, and dedicated to learning all the time.

Knowledge as the Foundation

Financial decisions that are well-informed are the result of a broad grasp. Proactive learning is necessary to establish a strong foundation of knowledge that can be used to identify opportunities and mitigate threats.

Adapting to Market Shifts

Adaptability is the defining characteristic of financial competence in a sector that often encounters rapid changes and market volatility. For stability, it is imperative to be able to adjust strategies while simultaneously maintaining a long-term perspective.

Dovrixal functions as a guide, providing access to teachings on concepts that include portfolio management, asset diversification, and liquidity. Dovrixal ensures that financial confusion is transformed into informed decision-making through tutor-driven education.

Investing, more than just making transactions, is about developing competence and self-assurance in one's financial territory. Dovrixal makes it easy to get tutor-led education, which could give users a leg up in their financial journey. Registration is fast, easy, and cost-free.

Interest rates, market indicators, fiscal policies, and other critical economic variables are essential for grasping investment conditions. With Dovrixal's access to structured learning, users can look into these factors and become equipped for the related terrains.

Recognition of the influence of global trade policies and financial regulations is essential for strategic investment planning. This is in addition to the fundamental concepts that underpin the process. A broad learning program ensures that one is able to adjust to changes in the economy and to new possibilities as they arise.

Obtaining access to extensive financial training is made possible through a free registration process with Dovrixal. This provides users with the opportunity to investigate investment cycles and the long-lasting effects of these cycles.

Conventional equities and bonds are not the only investment options available. Dovrixal works as a gateway to education that elucidates these options, offering structured learning paths for a more nuanced understanding of finance.

By providing participants with specialized training, Dovrixal encourages informed decision-making, enabling them to understand market dynamics and develop strategies that are specifically designed for their long-term financial goals.

Traditional investment methodologies are being redefined by financial technology. Decentralized finance (DeFi), digital payment systems, and robo-advisors are all sectors that are impacting the operation of markets. Educational firms that look into these advancements and their implications are linked to participants by Dovrixal.

The field of behavioral finance uncovers the psychological factors that influence monetary choices. This area explores concepts such as risk perception, decision biases, and market sentiment. Access to helpful resources that study the impact of cognitive patterns on investment behavior is provided by Dovrixal.

Microloans and community-backed funding are two examples of small-scale financial models that are very important for economic development. Dovrixal offers users access to information about how microfinance helps with business and long-term development.

Global markets, currency valuations, and inflation cycles have a direct influence on investment settings. Understanding these conditions is crucial for the identification of prospective benefits and risk factors. The Dovrixal website facilitates the connection between learners and groups that dissect these macroeconomic trends and how they affect finance.

The financial markets are being constantly remade by technological advancements, demographic shifts, and structural economic changes. Automation is disrupting industries, while international trade patterns produce fresh opportunities and risks.

A pathway to insights on these global shifts and their prospective financial outcomes is provided by Dovrixal.

This is a principle that is applicable to financial planning, business expansion, and investment management. It is oftentimes the result of calculated, progressive decisions that may yield exponential results.

In addition to individual endeavors, the utilization of market data, technological advancements, and professional networks may enhance outcomes.

Users are directed by Dovrixal to teaching groups that help them know how returns could be driven by reinvestment methods and long-term financial structuring.

Emerging areas such as artificial intelligence, biotechnology, and renewable energy sources are transforming industries and financial markets. Recognizing the prospect of disruptive developments can guide strategic investment decisions. Dovrixal offers access to resources that examine these tendencies, allowing participants to predict and respond to changing market pressures.

Consumer behavior and societal trends have a powerful impact on markets. Emerging financial strategies are influenced by shifts toward sustainability, digital economies, and ethical investing. By consulting Dovrixal, users get linked to specialists who analyze these shifting patterns.

Adaptable investment strategies are required in response to economic fluctuations, geopolitical events, and market volatility. Dovrixal offers entry to structured learning on methods for managing financial risks and addressing uncertainty.

A portfolio should be designed to maintain a balance of assets across various categories to mitigate risk and improve stability. Access to learning on asset allocation and risk-adjusted investment planning is facilitated by Dovrixal.

Margin trading captures the use of borrowed money to try and magnify capital exposure, therefore providing both higher potential returns and greater risk potential. Dovrixal offers access to learning resources that deconstruct this complex financial tool.

Before committing money to any venture, one must assess its market orientation, financial situation, and growth possibilities. Dovrixal links users to forums where they can understand how to evaluate long-term sustainability and business performance.

Market trends are vital indicators for financial planning. Recognizing patterns facilitates informed decision-making, regardless of whether one is evaluating bullishness or pinpointing warning signs of slumps. Dovrixal enables users to access educational groups that clarify the process of reading and reacting to market signals.

Adopting a comprehensive financial literacy program is essential for understanding intricate markets.

By connecting users with specialized educators, Dovrixal streamlines the process of obtaining investment training, thereby ensuring that users have access to structured pathways for skill development and insight.

| 🤖 Registration Fee | Zero cost to register |

| 💰 Administrative Fees | Fee-free service |

| 📋 Enrollment Ease | Simple, quick setup |

| 📊 Study Focus | Insights into Digital Currencies, Forex, and Investment Funds |

| 🌎 Country Availability | Available in nearly every country except the US |